‘I believe that in the future, whoever holds Alaska will hold the world.’

Billy Mitchell, US military aviation pioneer

The Strategic Importance of the Arctic

Alaska may appear isolated on a map, but it is actually the closest US state to northern Norway. In fact, cargo planes from Anchorage, Alaska can reach 90% of the industrial world in under 10 hours.1 This strategic location is a major reason why Billy Mitchell testified to the US Congress in 1935, foreshadowing the strategic importance of the Arctic, or High North. Viewing the world from a polar perspective, as US Army-Alaska does, clarifies its proximity to the rest of the northern hemisphere more intuitively.2 According to US Army-Alaska, this geospatial reality underscores one reason why Russia commonly encroaches NATO nations’ airspace in the Arctic, a desolate, yet strategically key, region.

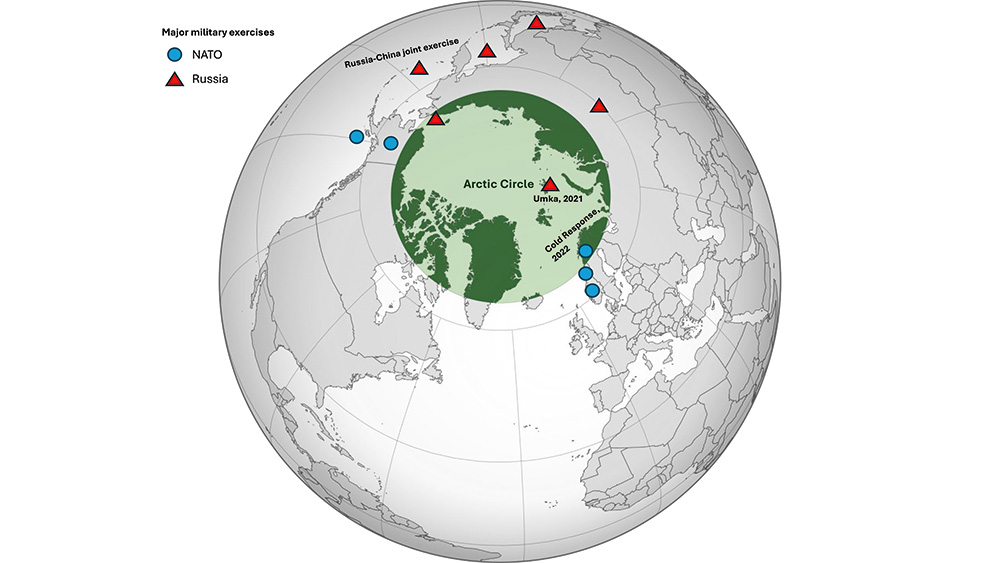

Besides the Arctic’s key airspace with proximity to most of the industrial world, climate change is leading to other geopolitical ramifications. Melting ice in the Arctic has paved way to new economic opportunities. As new shipping lanes emerge, claims are intensifying over the region’s oil and mineral resources.3 According to a high-ranking official within NATO, anxieties are rising in the Arctic and ‘High North, low tension’ is no longer the mantra as competitors ramp up military presence in the Arctic.4 For example, in September 2024, Russia conducted a major naval and air exercise named Ocean 24, part of which included deploying two nuclear submarines under the northern polar icecap. China shares Arctic ambitions as they joined Russia not only in Ocean 24, but also in joint patrols while also conducting their own icebreaker missions.5 NATO Allies have responded with their own Arctic exercises, increased patrolling, and protection of freedom of navigation and undersea communications links. Also, NATO’s two most recent accessions to the Alliance, Finland and Sweden, add territory to defend in the High North.

The Arctic and the Space Domain

The Arctic also plays a vital role for military and commercial space operations. Kongsberg Satellite Services (KSAT) is a commercial provider that operates the world’s largest satellite ground station from Svalbard, an archipelago halfway between Norway and the North Pole. The station, like others in the region, capitalizes on its northern latitude to maximize line of sight with satellites passing overhead in heavily inclined orbits. Besides space infrastructure designed for satellite tracking, telemetry, and control (TT&C), there is also American strategic early warning infrastructure at bases such as Pituffik Space Base (formerly known as Thule Air Base) in Greenland. The US placed ballistic missile early warning infrastructure there during the Cold War due to its location roughly halfway between Moscow and New York. Radars at sites like Pituffik can monitor for missile threats while also detecting and tracking objects in orbit. Since 2005, Russia has re-opened Soviet-era military bases in the Arctic,6 to include its own corresponding radar complexes.7 Their re-militarization coincides with strategic messaging from Foreign Minister Sergei Lavrov that Russia will defend its interests in the Arctic, both diplomatically and militarily.8 Likewise, Chinese space activities in the region have been expanding, as written about in detail in the JAPCC’s Journal Edition 30.9

Now with seven NATO Allies holding territory in the Arctic Circle, the Alliance must be prepared to defend its interests as well; however, doing so will come with new challenges. The Arctic’s harsh climate and vast, sparsely populated terrain have discouraged nations from investing in the typical infrastructure found near larger population centres. Much of today’s Satellite Communications (SATCOM) cannot adequately cover such northern latitudes. This means that, as one of many examples, a remotely piloted aircraft that typically operates near the Mediterranean may not be able to maintain the same SATCOM links from the High North.

One key nuance that operational planners, Allied defence procurement organizations, and NATO interoperability efforts must account for is the line of sight limitations of certain SATCOM architectures in providing coverage above (or below) of roughly 65 degrees north (or south) latitude.10 This is largely due to the current reliance on SATCOM from Geostationary Orbit (GEO) because it offers relatively stationary orientation from the Earth’s perspective. But there are trade-offs associated with SATCOM from GEO that are now becoming more relevant.

Falling Short in the High North

Satellites in GEO have been the backbone of SATCOM for decades because of the convenience for ground equipment to maintain connectivity, and the widespread coverage offered by their high altitude. Positioned far above the Earth’s equator, one GEO satellite can offer coverage for approximately one-third of the Earth, theoretically allowing for only a few satellites to provide global coverage. The precise altitude is chosen because it is the narrow sweet spot to park a satellite above the equator. As long as it is in a circular orbit, the satellite will orbit with the same angular velocity as the Earth’s rotation, thereby remaining stationary relative to any vantage point from Earth. The fixed orientation between any ground station or user and the satellite itself offers a stable and relatively straightforward architecture. GEO SATCOM does have signal time delays, known as latency, due to the great distance (35,786 km), but the benefits of GEO-based SATCOM have historically outweighed that inherent drawback.

Arctic nations have been increasingly carrying out military exercises in the region, showcasing escalating tensions. © Globe: © Heraldry, Isochrone/Wikipedia.org, CC BY 3.0; Overlay: © JAPCC

The limitations of today’s SATCOM in the Arctic stem from not anticipating the Arctic’s growing importance. A GEO satellite must be over the equator to remain in a fixed vantage point with respect to Earth. That geometry makes coverage of the polar regions difficult because a SATCOM user would have to orient their antenna to a very low elevation angle above the horizon. Even if the user can achieve line of sight with the satellite, this difficult angle could sacrifice the link’s reliability because the signal would have to fight through more atmospheric conditions, weather, and physical obstructions. While the Mobile User Objective System (MUOS) in GEO has reportedly provided coverage as far north as 74 degrees, that stretches the limits of a system not designed to deliver SATCOM that far north.11

Inclining GEO to reach higher latitudes would fundamentally alter the orbit to become a Geosynchronous Orbit (GSO). GEO and GSO both operate at the same altitude and complete one orbit per day, but the orbital tilt of GSO removes the benefit of staying consistently fixed over one point on Earth. If overlaid on a map, GSO ground tracks look like figure-eights, spending half the day over the northern hemisphere, and half in the southern. Therefore, embracing GSO would require multiple satellites for continuous coverage and eliminate the benefits of stationary satellites that is offered by GEO. Given the dilemma, NATO must look beyond GEO and GSO for SATCOM that can deliberately cover the Arctic.

Going Low to Cover High?

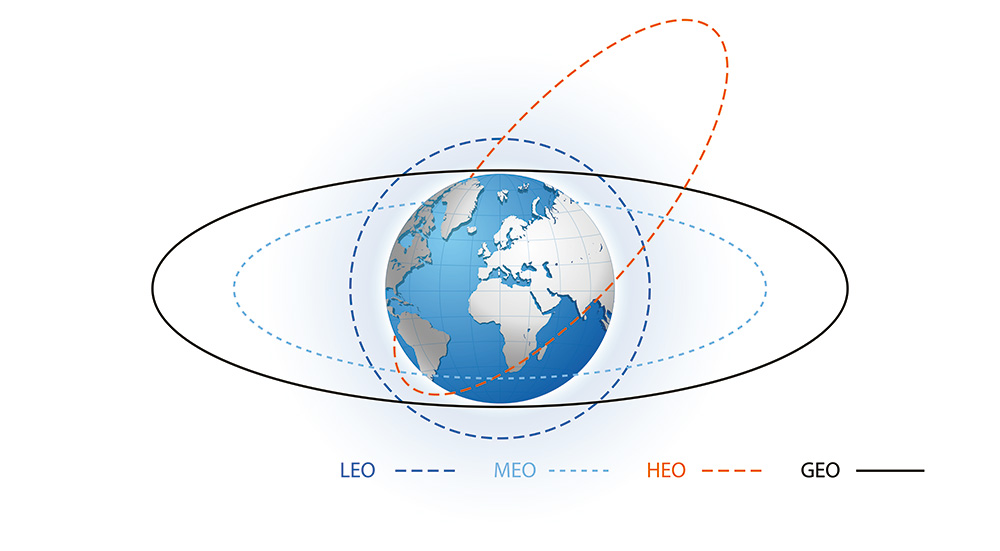

There are three other orbit types to consider for SATCOM coverage in the High North: Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Highly Elliptical Orbit (HEO). Each have their advantages and disadvantages, yet each has precedent in covering high latitudes for services other than SATCOM. Additionally, there are efforts underway for each to bring SATCOM to each orbit type. Each will be covered below:

A visual representation of the four major orbit types. © Copyrighted

The proliferation of LEO satellite constellations in recent years has been driven by commercial mega-constellations such as the UK’s OneWeb and SpaceX’s Starlink, which now consists of over 7,000 satellites, approaching half of all satellites ever launched.12 Reduced launch costs, smaller and cheaper components, and cost-sharing programmes are three factors fuelling the growth. These large constellations can offer worldwide coverage because LEO satellites are typically launched into highly inclined orbits, often tilted vertically so much that they consistently pass over the polar regions. Then the Earth rotates beneath the satellites to spread the coverage east-west over all lines of longitude. Furthermore, satellites in LEO offer lower latency than GEO due to their altitudes ranging only up to 2,000 km, thereby improving signal quality. Private industry and government agencies have long benefitted from LEO for remote sensing missions such as imagery collection and weather, but historically less so for SATCOM. Achieving seamless, worldwide SATCOM coverage from LEO requires at least 40–80 satellites for bare minimum coverage, and up to hundreds for practical usage.13 There has already been good precedent from companies like Iridium, but recent developments in the space industry are offering even more robust opportunities for SATCOM from LEO. SpaceX’s Starlink, along with their more secure and government-tailored variant Starshield, have demonstrated LEO SATCOM’s potential, such as recently enabling C2 for Ukrainian forces.14

A Brief Comparison of Orbit Types.

MEO, ranging from LEO’s upper boundary to 20,000 km, offers a compromise between LEO and GEO both in terms of the number of satellites required and latency. While satellites have orbited in MEO for decades, they have mostly been part of Global Navigation Satellite Systems (GNSS) that offer positioning, navigation, and timing (PNT) services, such as the US Space Force’s GPS, the European Space Agency’s Galileo, Russia’s GLONASS, and China’s BeiDou. One example of MEO SATCOM is the Luxembourgish company SES’s O3b mPOWER, which orbits at 8,000 km. They view this as a Goldilocks zone – not too high, not too low. Their chosen altitude reduces latency from GEO’s ~500 milliseconds to ~150 milliseconds, and only requires a fraction of the satellites required for worldwide coverage from LEO.15 SES has provided MEO-based SATCOM for over ten years; however, as a profit-driven company, its satellites in orbit cover between 50 degrees north and south, which in fairness is enough to provide service to 96% of the global population.16 There are plans to ‘eventually’ reach any point on Earth as the company adds to the constellation.17

HEO differs from LEO, MEO, and GEO in that the orbit’s shape must be elongated. A satellite in HEO will reach its apogee – the farthest and slowest point in its orbit – and then whip back around the Earth at LEO altitudes and much higher speeds. Due to those difference in velocities, HEO satellites will dwell near their apogee for much longer than their perigees. The Soviets’ Molniya orbit from the 1960s is credited as the first HEO and is still used today. Satellites in Molniya orbits have long dwell times at their 40,000 km apogees, alternating equally between coverage of ~63 degrees north over North America, then rapidly orbiting to re-emerge again at ~63 degrees north over Russia.18 The Soviets designed this orbit to maximize consistent coverage of the polar regions between the US and Soviet Union for missile warning, communications, surveillance, and weather purposes. The Arctic Satellite Broadband Mission (ASBM) is a two-satellite HEO constellation with US Space Force, Space Norway, and Viasat payloads onboard. It is an example of the cost-effective hosted payload model, also known as piggybacking or hitch-hiking (see ‘Hosted Satellite Payloads’ in JAPCC’s Journal Edition 38 for more information).19 Each satellite moves relatively slowly at their apogees above the Arctic for ten hours of their sixteen-hour orbits. Then, as one satellite descends out of view, the other ascends, taking its place. With only two satellites, ASBM provides uninterrupted coverage of the Arctic because of HEO’s long dwell times near apogee.

Way Forward

There are efforts underway to improve Allied SATCOM in the Arctic. As previously mentioned, ASBM is deliberately designed to provide SATCOM to Norwegian, US, and Allied forces operating in the High North. Additionally, in October 2024, 13 Allies initialized a multinational proposal, NORTHLINK, to explore the development of secure, reliable, and resilient SATCOM in the Arctic.

In the near term, NATO can seek interoperability with ASBM by requesting capacity in conjunction with the NORTHLINK initiative, of which the US and Norway are each members. HEO SATCOM can begin to address the current overreliance on GEO; however, NATO should continue to design a unified Arctic SATCOM framework under NORTHLINK that leverages multiple orbit types and providers to maximize availability across the Alliance. If conflict arises in the Arctic, adversaries will try to disrupt Allied space services. NATO can promote resilience in a contested space environment by augmenting HEO SATCOM with redundant SATCOM from LEO or MEO, or vice versa. Disrupting LEO or MEO SATCOM is more complicated for an adversary, due to the distribution of SATCOM across many, harder-to-target satellites, instead of one fixed high-valued target in GEO. The value proposition of a diversified SATCOM architecture extends its benefits beyond just the Arctic, as it would add worldwide resilience in lower latitudes too.

Over the past decade, many SATCOM providers like SpaceX and OneWeb have heavily invested into LEO constellations, demonstrating proof of concept for support to NATO operations. However, if NATO looks to incorporate SATCOM from MEO, it will likely need to provide explicit requirements to industry. The commercial space industry is profit-driven. Without a clear demand-signal, Arctic SATCOM will remain a lower priority for industry, as seen by O3b mPOWER’s standard services only covering up to 50 degrees north. If the Alliance desires SATCOM from MEO, NATO should formalize long-term service contracts soon to drive industry investment into high-latitude coverage.

There is unfortunate precedent of the military deploying an advanced capability on orbit that ground forces struggle to access for years due to outdated and incompatible user equipment. One notable example is military code-capable (M-code) GPS satellites which became operational in 2005. Two decades later, many ground units still cannot harness M-code due to the units’ legacy GPS receivers which are incompatible with the modernized GPS M-code signal.20 A similar situation could emerge regarding SATCOM in that units may have to procure new physical hardware to maintain interoperability. Unlike the GPS M-code example, it would not likely be due to microelectronics required to receive the unique signal type, but rather antennas that can track satellites that quickly pass overhead.

Augmenting SATCOM from GEO to other orbits will likely require terrestrial units to upgrade their user terminals to have steerable, phased array antennas. Unlike GEO SATCOM, which remains fixed in one location from Earth’s perspective, LEO, MEO, and HEO satellites are all constantly in motion relative to the user. Therefore, it is impractical to rely on mechanically steered antenna dishes to track the satellites. A phased array antenna, like those used for Starlink, uses many small antennas to electronically steer the link without moving parts. These instead rely on automated phase shifting of the electronic signal. As NORTHLINK and other SATCOM efforts move forward, procurement efforts will have to simultaneously dedicate focus to the corresponding user equipment to ensure interoperability. That may require procurement organizations outside of NORHTLINK to initiate their own acquisition processes in parallel.

Conclusion

As General Mitchell’s testimony to Congress predicted almost a century ago, the Arctic has grown in strategic importance. Therefore, NATO must prioritize Arctic readiness by modernizing its SATCOM architecture to ensure resilient C2 in the High North. As NATO’s competitors invest heavily in Arctic military capabilities, the Alliance must ensure it is not outpaced in the region. NATO should embrace multi-orbit SATCOM to ensure reliable C2 in the Arctic across the continuum of competition.