Introduction

The importance of Space-based capabilities in today’s modern world and especially in technologically advanced armed forces is beyond dispute. Satellite communications, precise positioning and navigation, time synchronization as well as Space-based Intelligence, Surveillance and Reconnaissance (ISR) bring inestimable advantages to the modern warfighter. The Military played a leading role in developing Space capabilities and was the primary user of Space-based services during the early years of the Space era.

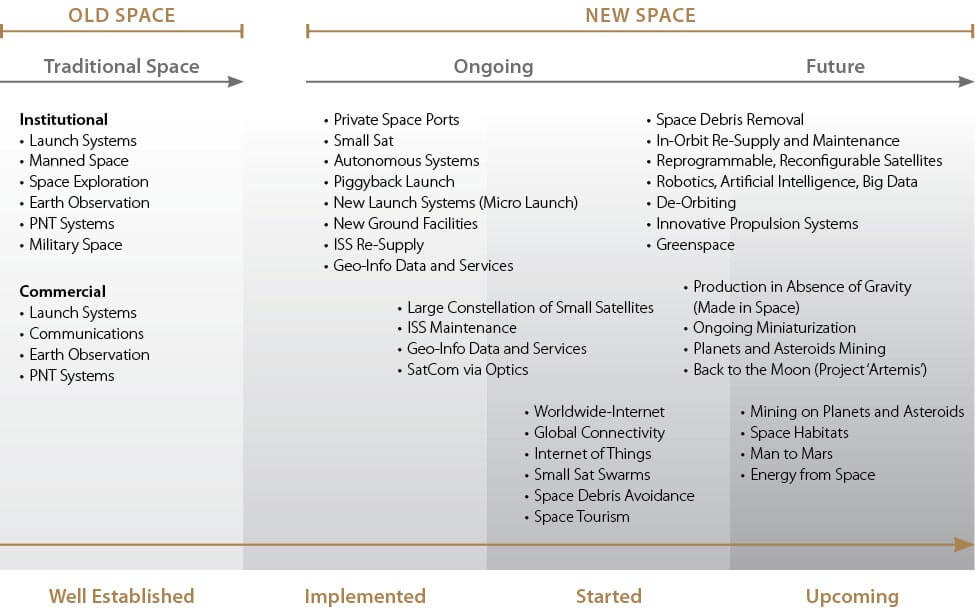

However, today, the preponderance of use has shifted, civil organizations and companies are the prevalent actors. This trend was labelled ‘New Space’ and seems to be the buzzword in current Space literature.

This article will shed light on the development of this trend, represent its characteristics and explain the importance of ‘New Space’ for the military, particularly in light of the likely future development.

Development and Attributes

The first actors in Space were governmental organizations, especially the military (e.g. German A4 Rocket development, first astronauts and cosmonauts) and for decades the military was driving the technological developments and the leading actor in the new frontier.

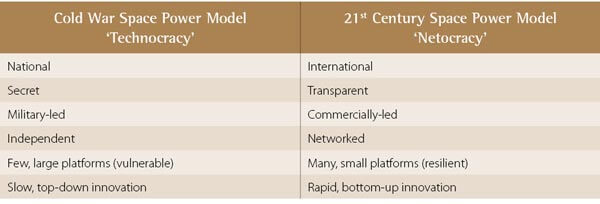

This era, named ‘Old Space’ or ‘Traditional Space’, was characterized by tailor-made solutions with a unique satellite design for long-lasting missions (10–20 years). The heavyweight of the satellites was usually 150 kilogram (kg) to several tons. Long-lasting project development times of more than three years, extensive testing of the components, as well as significant launch costs were key characteristics. The activities depended on governmental control as well as public budget with only a few prominent aerospace firms vying for government contracts. This was a bureaucratic top-down process with a limited number of competitors.

In the early 2000s, a paradigm shift for Space took place. Private actors started to invest heavily in the United States (US) Space sector. Ten years later, major changes occurred worldwide, especially in the two main areas – Space economy and Space technology.

Private companies discover Space as a new investing opportunity at their own risk, looking to provide specific Space-based services that have the economic potential to generate substantial financial returns. Modern forms of financing (Crowd Funding, Venture Capital Investments) and business models have been increasingly applied. The headline ‘Space, the final Economic Frontier’ is an accurate characterization of the shifting development direction of Space.1

The trend to smaller satellites (mini, micro, nano, pico, femto2) is the most significant aspect of the technological area. A forecast of expected launches into the Low Earth Orbit (LEO)3 until 2030 shows, that 68% will be small satellites weighing one to 15kg and an additional 25% weighing 16 to 75kg.4 Standardized interfaces and form factors, as well as the use of industry, certified Commercial Off-The-Shelf (COTS) components and pre-qualified parts and systems are common characteristics. Rapid design times of less than one year, paired with shorter mission lifetimes of up to seven years and quick-launch capabilities (newly specified spaceports like ‘Spaceport America’, ‘Mojave Air and Space Port’, ‘Mid-Atlantic Regional Spaceport’) at affordable cost are additional attributes of ‘New Space’.

Short delivery times, serial production, a high degree of standardization and lower prices are the results of the previously mentioned changes in Space economy and Space technology areas. Access to Space is easier for an increasing number of countries, organizations and companies. This entails a massive expansion of Space protagonists. More actors from nations and commercial organizations mean more opportunities and more competition. This leads to a new ‘Space Race’ for scientific and technological advantages as well as social and economic challenges.

These ‘big steps’ of improvements in Space-based services are a consequence of shorter and quicker decision processes in civilian companies compared to governmental and military organizations. Additionally ‘New Space’, ‘Industry 4.0’ and in particular the Information Technology (IT)-sector (Smart Manufacturing, Industrial Internet of Things, or Cloud Computing) are heavily interacted and dependent on each other.

‘Old Space’ was mainly a research area. ‘New Space’ is characterized by a technological approach of innovation and products, as well as new business models with a high degree of commercialization and decentralization. It is a highly dynamic and visionary process that opens up new commercial areas beyond the traditional aerospace sector. Public funding is still a significant source for large Space programmes, but in the area of small satellites, private funding is rapidly growing.

Benefits and Risks

‘The dominance of the commercial sector in technological development is an on-going major trend, as well as their growing in areas where states used to dominate.’5

In 2017 Global Space activity accounted for $383.51 billion and the total revenues from the commercial Space sector were 80.1% of the global economic activity in Space, or $307.32 billion, including private and public activities.6

The commercialization of Space – and of its prerequisite, the commercialization of Science – allows new applications and are a precondition for future new disruptive technologies7 on Earth. This ongoing development means more extensive benefits as well as higher risks.

The main benefit is a better cost-value ratio. New satellites are cheaper, and a shorter life will be compensated by shorter replacement periods, to ensure that satellites with state-of-the-art performance are on orbit at all times. As a result, small satellite clusters will replace a substantial number of large satellites.

Another benefit is intensive networking with the information and communication business, which represents the main driver for Space technology as well as an intensive cooperation with government, industry and academia.

Risks are high on initial investments for complex products, high general business risks, open questions in liability and insurance obligations. Especially in their starting phase New Space companies need a special degree of patronage of government and anchor costumers.

Legal issues are ongoing obstacles in the commercialization of Space. There is an existing clear framework around Space activities; however, questions about commercial Space aspects remain. Some nations adopted new policies to regulate their national commercial activities in Space; e.g. US ‘Space Act 2015’8, or Luxembourg’s law for extraction of resources on other celestial bodies and asteroids.9 To which extent this is in line with international Space law and treaties needs further investigation by Space law experts. Generally speaking, the current development for further use of Space by state and private users can appear as not only an urgent but also an intractable problem. Many of today’s Space activities are not regulated in existing international and national Space laws and treaties. This lack of clear rules and process is driving up uncertainties and risks for commercially oriented companies, and a greater regulatory clarity is urgently needed otherwise they will operate in a ‘grey zone’, which can lead to incalculable financial risks.

The United Nations are developing a Space Agenda with specific consideration of economic aspects.10 As a consequence, experiences out of today’s commercial activities will have a major influence on future Space law.

Military Challenges and Implications

Two main aspects of ‘New Space’ are essential for the military: the unrestricted usage of own national Space assets and the guarantee of safety and security in Space.

For their usage of Space, militaries have specific requirements and standards for their equipment. These differ somewhat from civilian requirements. In this view, the advantage of ‘New Space’ – buying developed and available products on the market – is not necessarily an advantage for the military. The possibility to use commercial equipment would reduce investment cost and shorten the procurement lead time. These satellites are mass products, they are usually cheaper, more readily available and successfully tested, however, not necessarily optimized for military needs. Slight individual adaptations concerning specific military requirements are still possible, but increase the cost and the time to be operationally ready.

There are, therefore, some disadvantages to seeking existing commercial products for military use. Only minimal adaptations are possible, and the market offers only a few or in some cases no suppliers for individual military products. Specific military requirements (military-grade encryption of data/data links, reliability, availability, access) require extensive customization at significant cost or new developments. Vulnerability and availability under combat conditions certainly present challenges.

Otherwise, if using a mass-produced satellite, the military is no longer the sole user. Other users of this product-line are eventually non-military or non-NATO states, maybe even a potential adversary. This raises the fundamental question for defining specific components or applications with individual military requirements and on the other side fields where COTS products may be sufficient. A high degree of dependence on commercial offers, if they don’t pursue activities with respect to military requirements could lead to loss of specific knowledge and competence.

In general, NATO has an open-minded approach to these challenges. As an example, NATO’s Joint Air Power Strategy states ‘capabilities for reconnaissance and surveillance must be tailored and take advantage of cost-effective technologies’.11 It also includes ‘Acquisition of commercially developed capabilities, especially networked capabilities, must occur in a flexible and timely manner and balance potential cost savings against the risks of supply chain cyber intrusion’.12 In addition, a NATO Science and Technology Organisation (STO) research is titled ‘Opportunities/Implications of large scale Commercial Small Satellites Constellations to NATO Operations’.13

Guaranteeing safety and security in Space is increasingly challenging for any Space Surveillance and Tracking (SST) capability. Today millions of pieces of Space debris, including ~20,000 parts larger than ten cm in diameter are orbiting the Earth and creating a high risk for collision. More actors in Space means more objects in Space, leading to more Space debris (despite Space-debris mitigation measures) with a higher risk for collisions and the need for more collision avoidance manoeuvres. This results in less operational time for each individual satellite and therefore a higher rate for replacement. This requires a highly sophisticated SST capability with modern sensors, well-equipped operation centres and well trained personal. SST, Recognized Space Picture (RSP) and in future, the Space Traffic Management (STM) are typical (but not exclusive) military tasks, and the requirements will rise at the ratio of more activities and actors in Space.

The reduction of the Research and Development budget in defence spending combined with increasing commercial innovation led to an overreliance on commercially available solutions, therefore, the loss of defence-focussed Research and Development skills may increase security risks.14

There seems to be no limit in theoretical thinking: latest and highly surprising is a US Air Force idea for utilizing commercial satellites for nuclear command and control.15 This idea emphasizes the need for resilience and US Air Force Chief of Staff General Goldfein stated ‘… the rapid and exciting expansion of commercial Space and bringing low-earth orbit capabilities that will allow us to have the resilient pathways to communicate’.16

‘New Space’ will force us to contend with great competitive dynamics, resulting in frequency-management due to mega-constellations and high numbers of planned new satellites.

Additional challenges, connected to ‘New Space’, are resurgent Russian and emergent Chinese Space activities with fast development and deployment. This might lead to a new strategic competition or a ‘New Space race’.

As a first answer to these challenges, NATO published the ‘Overarching Space Policy’ in June 2019, emphasizing Space is essential to coherent Alliance deterrence and defence.17 This initial step could be the starting point of an unrestricted adoption of Space in NATO’s planning, operations as well as organization. The next step could be NATO’s recognition of Space as an ‘operational domain’.

Conclusion

Fifty years after Apollo 11 astronauts first walked on the moon, the world is in a ‘New Space’ era. Outer Space, a domain once reserved for the great powers, is democratizing. New spacefaring nations and private corporations are entering the new frontier and taking advantage of new technologies and lower financial barriers. Previous Space actors no longer have the monopoly for access and operations in Space. New actors in the form of profit-oriented companies are seeking to conquer Space. Creating new business fields to make money and new funding opportunities is the economic trend. New technologies and production facilities open up new spin-off possibilities and therefore are an engine for transfer of technology. The driver for further developments in Space is no longer governmental organizations, but private companies. More companies demand more competition, this generates more variety, and in the end more changes and risks. Today we are at the beginning of new development in spacefaring – the impact of which cannot be predicted.

As NATO depends on support from Space assets, they have to have a close look at these trends and remain engaged. NATO must be a driver for capability development in Space and for alternatives like High Altitude Platforms (Near Space), use of commercial civilian satellites for military needs (e.g., US Space-based Kill Assessment)18, and launch-on-demand. New forms of organizational cooperation with private companies in all areas of interest have to be investigated.

Increasing activities in Space require more and better coordination of orbits than current Space Situational Awareness and postulate a RSP as well as means for Space Traffic Control. Legal and regulatory developments must keep up with the pace of technological innovation. While regulations for the airspace are under national jurisdiction, common agreed UN regulations in Space are necessary to avoid risks and conflicts.

It has been a postulation for the military at all times, to be at the top of technology. For the area of New Space, the door for close cooperation must be opened. A strong networking which keeps more than one eye on ongoing technological developments of private actors and adaptation of their solutions for military needs might be very fruitful. Proven commercial solutions can offer additional chances for the military to optimize for space-specific challenges in financial, organizational and technological aspects.